Business Insurance in and around DeRidder

One of the top small business insurance companies in DeRidder, and beyond.

Helping insure businesses can be the neighborly thing to do

- DeRidder

- Merryville

- Rosepine

- Ragley

- Longville

- Dry Creek

- Singer

- Grant

- Sugartown

- Fort Polk

- Oakdale

- Oberlin

- Reeves

- Dequincy

Business Insurance At A Great Value!

Whether you own a an art gallery, a pet groomer, or an antique store, State Farm has small business protection that can help. That way, amid all the different moving pieces and options, you can focus on your next steps.

One of the top small business insurance companies in DeRidder, and beyond.

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

When one is as committed to their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for worker’s compensation, commercial auto, commercial liability umbrella policies, and more.

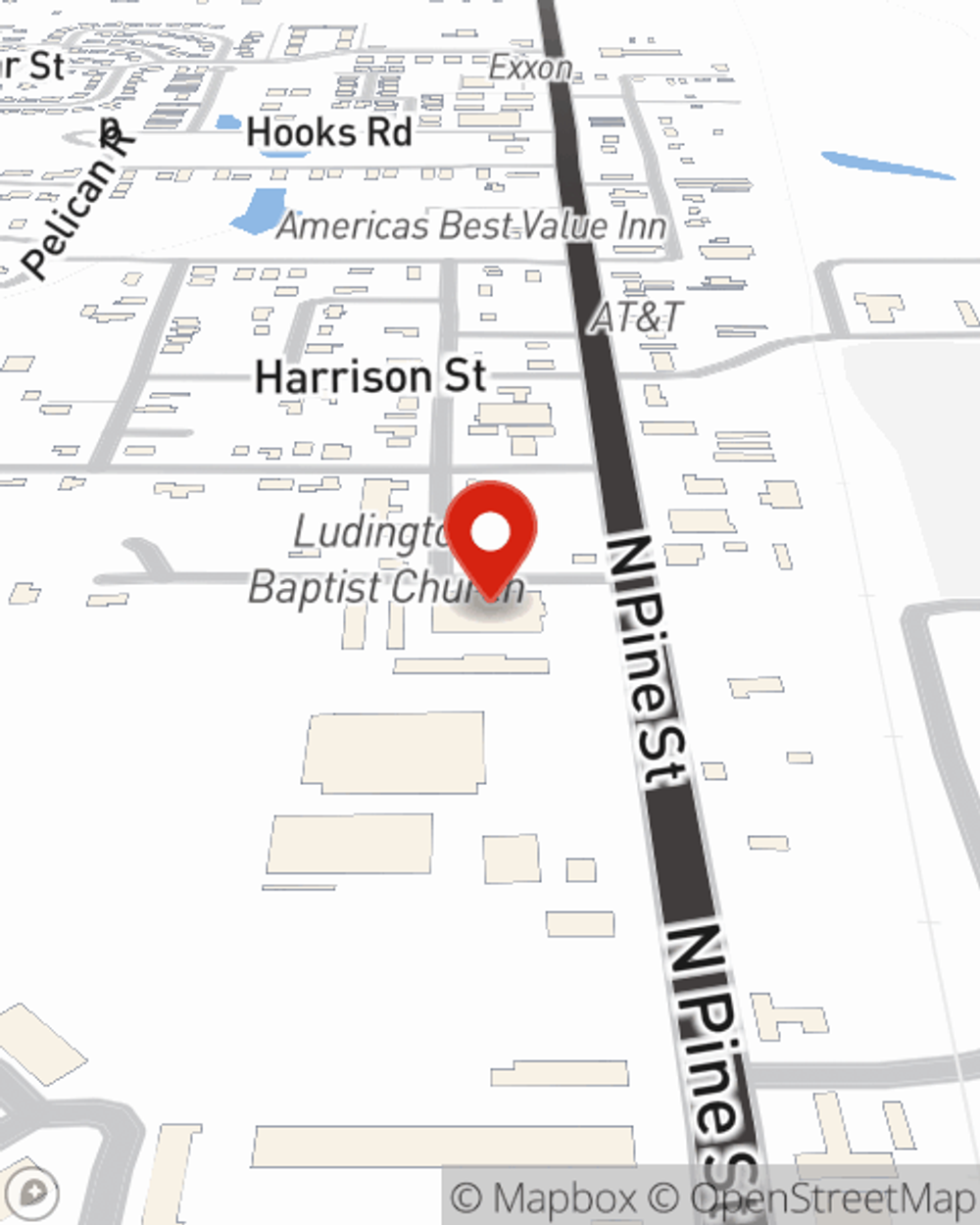

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Seth Joubert is here to help you discover your options. Visit today!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Seth Joubert

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.